About Me

- Mr.Lex

- Oxford, United Kingdom

- Friendly,Nice and...Hardworking...maybe???...(^_^)...Kekekekeke...

Thursday 30 April 2009

Swine Flu Homework!

First of all,Swine flu is a serius desease that may affect in people's life and it causes lower living health and standard as well.This is a one kind of flu and causes lower health and demotivate workers to work.Therefore,it leads to a decrease in productivity and may reduce the achievement of the consumers expenditure.Therefore,because of the swine flu, aggregate demand will shift to the left which may cause unemployment in the long run.As,swine flu is flowing over people's environment,people will go outdoors less will buy less.This may leads to a decrease in the AS.So Swine flu is the big problem to the economy of the country and causes many problems.

For example in Mexico,there is the biggest number of people that have swine flu.It may affect on Mexico's international trade.Other countries will buy less Mexico's exports,not only pork but also other kinds of meet,because they afraid of the illness will appear on their country.So this will make balance of payment deficit even worse.Therefore,at the average point,the swine flu really harms country's economy.

But it depends also on the which country.The swine flu will have less chances to be appeared in the countries that have religions against pork meet like Muslims.For example,Kazakhstan or Arabic countries will have less chances to have swine flu,therefore,other countries will expect that there's no swine flu in Muslim countries.This will make exports of meet in Muslims countries to increase a lot.And this may cure the balance of payment deficit,and boost AD and AS in the long run.

People may go out and buy a lot of anti cold medicines or hand sanitizer and this will increase demand for it,but the problem will be their spending on the medicines to increase government's revenue is much less than the cost to teh social.This deasease is infected,therefore,it's a negative externality as it also cost to the third party.Therefore,the Government will have to spend a lot on the NHS and it will be much more expensive than people's spend on cold medication and hand sanitizer.And as people will have more swine flu,it will reduce pructive capacity of a country in the luong run because of a decrease in productive capacity!

Therefore,I don't agree that swine flu will benefit the economy.

Tuesday 28 April 2009

Champions League!

Now starting to revise for tmr mock!:)))

Monday 27 April 2009

OMG!!!!!!!!

Damn meeee!!!!

I was so lucky that it was just a mock.I didn't read carefully the last question.

Therefore,thanks to EF that makes these mocks exams to improve these experients,and preparing us to the real exams.

Now,my experient was...Read Read Read and Read very carefully the questions,even it's really short.Ok,the question was:"What are the causes of the economic growth?"...Well it sounds simple isn't it.But if you read it roughly,you may make stupid mistakes and misunderstood the question like me!....I understood the question....like....What economic growth causes....???...Oh dumb me!!!!....

No comments please!!!!!Again,thanks to EF but anyway I'm thinking of moving school!:)))

Sunday 26 April 2009

Examiners reports!

- (a) (i) Identify 2 characteristics of a public good

- (ii) Explain 2 reasons why "education" is not a public good

In addition, whilst many answers gained reward for stating that education could be seen as being excludable because some parents cannot afford fees or because people live outside of a school’s catchment area, a number of candidates tried to explain excludability in terms of one candidates use of education limiting another’s. This was clearly not accepted as an explanation of excludability.

- (b) (i) Explain what is meant by externality

- (ii) Identify one possible example of a positive externality arising from education.Explain why this is a positive externality

- (iii) Using a diagram,explain how the existence of positive externalities can lead to market failure.

Better answers focused upon the issue of under consumption and explained that this would arise as a result of individuals basing their consumption decisions solely upon their private benefits and, therefore, ignoring the external benefits of their actions. This was then developed in terms of the resulting underproduction leading to allocative inefficiency and a misallocation of resources. Clearly such responses which answered the question directly using accurate economic terminology were well rewarded.

- (c) (i) explain why market dominance can lead to economic inefficiency.

- (ii) Explain how competition policy can be used to stop firms abusing their market dominance

- (d) The information provide states that the government may subsidies the supply of products which generate positive externalities.Discuss the effectiveness of subsidies as a solution to a market failure arising from positive externalities.

The only difficulty arose where candidates used this question as an opportunity to write about other forms of government intervention. Unfortunately, given that the question required specific discussion of subsidies, such answers could not be credited.

Overall, with candidates clearly well prepared for this final question, the responses were generally very pleasing indeed.

BGT Episode 3!

And..more and more competitors with Flawless:Diversity!

Choices....Confusing.....Dissapointed.....

Now this is an experience....Never watch schools videos to make choices such as this one!:

Wednesday 22 April 2009

Why does the aggregate demand curve slope down?

As in the AD,AS diagram u always can see that AD curve slopes down.It has a negative slope.Why???

Three explanations for the negative slope are:

1. Interest rate effect

2. Real balance effect

3. Foreign purchases effect

- Interest rate:

- Real blance effect:

It is proved through consumption and expenditure. As price level rises, purchasing power of money balances falls. As our real wealth falls, we will cut back on our consumption spending,which means consumption will decrease.Therefore,this will leads to a decrease in Real GDP in the economy.

- Foreign purchases effect:

It is applicable only to open economies with foreign trade being introduced into our explanation. With an increase in domestic price level relative to those of trading partners, domestic consumers will spend less on domestically produced goods and services and more on imports (M). Also, foreigners will buy less of our exports (X). The increase in M and decrease in X (that is, a decrease in net exports) means a decrease in real GDP.

Tuesday 21 April 2009

Discuss how an increase in aggregate supply may effect output and inflation!

Aggregate supply is the total supply in the economy of a country.Inflation is there's an increase in the price level.An increase in aggregate supply may caused by raw materials became cheaper or a decrease in the worker's wages.An increase in the aggregate supply will increase outputs in an economy.In the long run,an increase in aggregate supply will leads to economic growth and could be beneficial because it will also reduce unemployment as there's an increase in Real GDP so that,more jobs will be available for unemployed people.AS increases will also make domestic products be more competitive,and also the country will be available to export more.As exports are on of the components of AD,and ceteris paribus,AD will likely to increase as well.

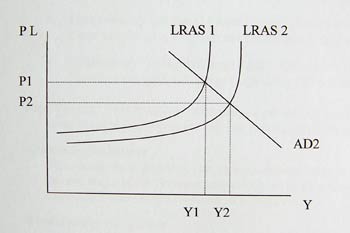

As in the diagram below explains the affect of an increase in AS to Inflation.

A shift righwards in AS will leads to an increase in the price level.According to the diagram,the price level decreased from P1 to P2 which means inflation has been reduced.As AS increases,there will be more outputs produced by firms and industries in the economy.So that,inflation is likely to be reduced because there are no scarse products with high cost materials,and also to increase AD as well.

A shift righwards in AS will leads to an increase in the price level.According to the diagram,the price level decreased from P1 to P2 which means inflation has been reduced.As AS increases,there will be more outputs produced by firms and industries in the economy.So that,inflation is likely to be reduced because there are no scarse products with high cost materials,and also to increase AD as well.However in the long run,an increase in AS will also leads to an increase in AD.So that,inflation will be depend on how much an incease in AS compare to AD.Because if AS increses and economy is growing so AD will grow as well.And if it increases more than AS therefore it will be a demand pull inflation.Also it depends on how much AS increases,if AS increases too much,and AD can't exceed it,therefore there will be overproduction and waste of materials and resources.

Monday 20 April 2009

Jelly Click Mouse!

If you find a computer mouse too hard and unyielding,this Jelly mouse could be a winner as it feels floppy and like...jelly.

The business is about new mouse that can be folded and become a really small mouse with taking not a big space in your luggage.But actually...this is not the good idea and a creative product.

Well the strength of this product is as i can see it can be fold to be really small so that,the technology to do this product is quite new.If you've ever attended a trade show or, indeed, gone on holiday, you'll know it sometimes something of a challenge to cram all your geek gear into one bag.It can be done but usually means sore shoulders and unusual bulges.Also,it can be blowed up to be a normal mouse so that's why it called jelly,which is a little bit createfuk.

But everyone knows that a mouse of a laptop is not a big product.Even the biggest mouse could be fitted in a small case of the luggage.And also,the design of the product is not colourful and nice.Just simple and looks weird.I don't like this product.And another problem might be if it will be broken,so it can't be fixed because...there' no screws to open it.So just throw it then.

*Strengths:

- Can be folded smaller.

- Can be blowed up to use

- It can stand heavy things because it's jelly.

- Bad design

- Hard to fix

- Not very suitable because normal mouses are small as well.

Saturday 18 April 2009

Brittain got Talent!!!!

It's here!

Whaaaaaaaaat!!!!!!!!She got through the round.......!!!!!OMG>......Now I know what is women's strength......... ~ ~...No evaluation here.....

Anyway,This season,one Susan Boyle or FLAWLESS will defenetely win or guaranteed to get to the final...Amazing...I'm staying awake until 3 am to watch BGT...Here are FLAWLESS!!!!!Damn perfect!

Thursday 16 April 2009

Evaluation:Airzooka,Air bazooka!

As a variation on other toy"weapons" for children,the Airzooka shoots only air.Live demostration in front of children to harness their "pester power" is highly recommended.It also glows in the dark.

This new product is very safe and fun.It's called Airzooka because it shoots just air in front.So that,it will be just like a strong wind goes through like a bullet.Children might like this product because in young minds they have creative imaginations.Also parents don't have to care about the product because it's an absolute safe!It's a really simple but useful gun!

But the main thing it's just relevant for very young children,at the age of juniors or teenagers,demand for this product won't be high.And it just can shoot small and light objects such as cards or plastic cups,which children might get bored of that.

How does it work?

All you have to do is pull back the elasticated rear section and release it catapult-style. Airzooka then propels a powerful pocket of air straight at your intended target. It's a bit like having an invisible pair of mega-powerful bellows. With its walloping phantom blasts, Airzooka is ideal for convincing workmates there's a poltergeist in town, or simply confusing them to the point of insanity. They really won't know what's hit them!

You can also have immeasurable fun ruffling a vain colleague's hair, furtively blowing his/her paperwork all over the place, or indulging in a little target practice with a few paper cups. So what if Airzooka resembles something that Dick Dastardly might use to bark orders at his Vulture Squadron. The point is, this colourful cartoon-esque contraption is brilliantly simple, never runs out of ammo and brings a whole new meaning to the phrase 'air gun.'

STRENTHS:

- Simple product and low cost

- Very safe

- Never runs out of...ammo...=))

- Just relevant to very young children

- The decorations of a product is bad.

- Children might get bored easily

Case study answer!

Answer:

Break-even point (BEP) is the point at which cost or expenses and revenue are equal: there is no net loss or gain.With Break Even analyses,the entrepreneur can meet and may exceed the guarantee of not making a loss.It may manage and set up a plan and aim to sell that amount of a product to make sure and check that selling that product is not making a loss.Also,by break even analyses,it may control and check is the business going well and does it meet the aims of selling the amount of products that have been set up.According to the case study,the financial planning for Foodeaze was thorough and at first all went well.Within 5 weeks of opening the business was close to it's break even level of sales.So that it means the entrepreneur knows how his business is going,and also helps to make later decisions.

But the break even analyses is not included all factors that might affect on the sales of the business.It just calculates and includes simply as price and volume to sell.It can't always go straight way like that and there are more factors to care about.About the volume,the business can't guarantee that it can always sell all of that volume.And the price in break even analyses is always the same,but in a business of course you have to have pricing strategies to be relevant to business.It doesn;t consider also about other factors like competitors,economy situation so that it might be wrong or too simple.In the case study,the new store nearby sells similar products led to sales falling and break-even becoming a distant possibility.So this is the experience of Foodeaze not always accord to Break even analyses because it doesn't include competitors research.

In conclusion the break even is useful for starting up businesses but we can't always relate to that to make choices because it might be wrong.BE analys is just the first steps of planning to make profit.

Tuesday 14 April 2009

Podcast:Recession hits rural communities!

Cornwall and other rural parts of Britain are being hardest hit by the recession, according to new research from the Commission for Rural Communities.In parts of Cornwall more people are applying for available job vacancies than anywhere else in the country and there's also a shortage of job centres.

The rural communities hurt by recession very much.According to the latest research,in Cornwall and other poorer cities have the highest increase in unemployment and Cornwall is particularly badly hits.The worse thing is that in that places,the job centres are closing down rapidly and in Cornwall 6 job centres are already closed.So it means that unemployment is increasing and also job centres are closing down.So what can be worse.It's very hard to find a job centre and this leads to a difficulty of finding a available job vacancy.

The problem is not in the job centres that they're closing down,said the worker in the job centre,but the problem is that they're trying to excess jobs for people and they're failing in it.And also they're trying to create jobs online.And people that are seeking for work are having a hard time.

The problem is,is it done enough to fix this bad economy situation and also to cure the unemployment,which is rising sharply.

Finally...I found out!!!!

That younger girl...looks like my younger sister (right hand side picture)!!!Look look look!

...

...Same glasses and my sis has the same pink and white t shirt like that....hahahahaha....Nice......More connections....hmmmmmm...xD

Monday 13 April 2009

EF help!!!Breakfast is important

Well so what we have on EF's breakfast.

Please note that it's always always always the same!

First choice Banana OR Apple OR Yogurt OR Juice(Which is the same as dinner as well,and notice the word OR)

Second choice is White or Brown toast

Third choice is Milk

And a cup of tea or coffee....!

Well it sounds bit a lot BUT...how can we live for 2 years and everyday eating the same!Same toast,same banana or apple or yogurt or whatever but there are mountains of complainings about a breakfast,because it doesn't change................................!!!!

This is the research about the breakfast on Yahoo!

IS BREAKFAST THE MOST IMPORTANT MEAL OF THE DAY?

Don't try to cut calories from your day by skipping breakfast. Recent research from a study conducted in both Venezuela and the U.S. indicates (once again) that breakfast is an important meal.

This study, which included 94 obese women, showed that a big breakfast (610 calories) that included plenty of carbs and protein, when followed by a smaller lunch and an even smaller dinner, resulted in significant weight loss over several months, when compared to a lower-carb diet.

We've known for some time that people who eat breakfast often weigh less than people who skip it. One reason for this is that people who skip breakfast are actually making themselves extra hungry and so are probably going to eat more calories throughout the day. Breakfast can help to control hunger and give you lots of nutrients and energy to start your day.

Another reason behind the weight loss-breakfast connection is that breakfast jump-starts your metabolism. Think of your metabolism as a fire. Overnight, the fire dies back; breakfast is like the wood that gets the flames crackling again. If you don't start up your metabolism early in the day, you won't be burning all the calories that you could be.

While you needn't eat a 600-calorie breakfast every day, you should take away the message that it may still be the day's most important meal. Here are some tips on eating a healthy breakfast

- It should control cravings and keep you feeling fuller longer.

- Include some carbohydrates, protein, and healthy fats.

- If you eat a high-calorie breakfast, then keep your other meals lower in calories.

- Always try to serve breakfast to your kids — they'll concentrate better at school, have a healthier body weight, and get more needed vitamins and minerals

I hope I will have the same breakfast as here...wow...where is it?:

She''s nice!!!!!That's VIETNAM!

She''s nice!!!!!That's VIETNAM!

Well who agree with me can comment on my blog!

P.S:More information about Vietnam:

This video included all of infos!

Sunday 12 April 2009

Business Idea:"Clocky" Evasive Alarm Clock!

Coming back to business Studies Post and again:EVALUATION!

The new business idea has been created which is very "Nasty".People who always over slept don't have to worry again.People who are over sleeping usually have the hardest time when they can't move their butts out of their beds and then continue sleeping...=)Therefore to solve this main problem,NANDA clock is in the market.

This is the high quality product with many details and instructions.First of all,the company's guarantee is high :a standard 90 day return warranty for product that is determined to be defective. The company will happily refund or replace your item at no additional charge.

Also their Clockies have a very loud alarm clock. The reading is 83 db at 1 meter and 100 db at 85 mm.But also this could be a problem as well.Imagine around you small kids or babies are sleeping and the alrm clock is too loud.It can woke all up and involve troubles.

The main USP of this product is it has wheels.It scurries around your room when the alarm rings so you ave to wake up and get out of bed,find him,turn the alarm off.Well the difficulty of this product is also because of wheels.If you put it in the high place,while it runs,it could fall down and easily be broken.Or as I said,there's no volume control which may wake up a whole family and also if it runs to small places such as under the bed,it will be hard to turn it off.

But the design is perfect and also people like their stuffs funny and cheeky.The design is very cute.And it has many colours for consumers' choices.

In conclusion:

*STRENTHS:

- USP is it has wheels,and it can run

- No more worries about oversleeping

- Beautiful design

- Small and easy to control

- No volume control

- It can be broken if put it in the high place as it can run

- Takes time to find it

- Could be a little bit annoying =)))

Friday 10 April 2009

Credit Crunch Review!

Well before I just thought credit crunch is just a situation when there is a huge and fast economic growth so that consumer's wealth increased a lot.The most valuable wealth that they have is houses.So that they put high prices on their houses and so that,poeple that want to buy a house,they have to borrow money from the bank which is called mortgage.But then suddenly house prices went down rapidly and then the situation happens when consumers buy a house that is less wealthy than the mortgage than they buy.So that they can't pay off their mortgages and this leads to condumer's confidence decrease a lot and also it will be more difficult to borrow money form the bank .There fore,investment of businesses and firms go down a lot as well.This leads to economy to slow down and recession and so on.

But after reading the passage,I know more and detailed about this economic situation.Well ,in my opinion,the clearest and the easiest part to understand was an introduction part and a Section 1- Background part.I knew more detail about the mortgage and also the situation when the banks sell their mortgages and earn profit,which is called "securitization."That's why in terms of high economic growth it's so easy to borrow money.Just because,the banks can make profit easily so that they make securitization.

The most interesting part I found was the back ground of the Credit crunch which explains what makes credit crunch to explode and why it happened?And more difficult one was the implications of the credit crunch which I didn't read quite carefully.

In conclusion,I think that this passage was very useful and easy to understand as well.Also It explains clearly about Credit crunch (well,I think too clear) and I think all parts were right.

Ahhhh ye ye...Stupid me!I misses 2 big mistakes in the passage.........

Wednesday 8 April 2009

Credit Crunch Revision Pack!

- INTRODUCTION:

A credit crunch generally involves a reduction in the availability of credit independent of a rise in official interest rates. In such situations, the relationship between credit availability and interest rates has implicitly changed, such that either credit becomes less available at any given official interest rate, or there ceases to be a clear relationship between interest rates and credit availability (i.e. credit rationing occurs).

This update comprises of three main sections.The first is concerned with the background to the credit crunch in order to give some historical context to what happening.The 2nd section will look at some of the implications of the credit crunch and how businesses arebeing affected.Final some curricular linked activities and concepts will be relater to the issue.

- SECTION 1:BACKGROUND:

Mortgages are loans against the house,that is to say most poeple need to borrow money when they buy a house.Usually ,a person saves up a deposit and rest from a bank or other financial institution like a building society.Then they pay this off over a period of time,usually around 20 years.This means that the bank will be receiving money for a long while.There fore if they sell off these loans to someone else,they get their money back,amke some profit and can lend it again very quickly and make even more money though.This is called securitisation,which also means that the banks that buy the mortgages will earn good money over a period of time.

Well so that,especially in the USA,house prices rose rapidly as people found it easier to get a loan.However,the increase in money available in the US led to a large increase in loans to people who didn't fall into this traditional 'prime' category and the growth in "sub-prime".Because these poeple are at the higher risk of notpaying their mortgage back ,they are charged a higher interest rate ,which makes it more prfitable to lend to them.Finally,some banks lent money well in excess of the value of the property.

So this is teh summary of what happenned:

- Lots of lending available because of "securitization"

- European and Brittish banks buy a lot of the mortgages from American banks

- House prices increse rapidly

- Bank lending to riskier customers increases a lot and lending in general is at record levels

- The world economy is doing very well(Economic Growth)

- House prices in the US started to fall

- BAnks who lent money started to lose money

- Banks in the UK & Europe who had purchased the securitised mortgages lost a lot of money

- People and businesses started to lose confidence so invest less,made people redundant which made the situation worse.

- SECTION 2:IMPLICATIONS OF THE CREDIT CRUNCH

- The Financial Sector:

- Brittish based banks are in severe financial difficulties

- Brittish based banks are making record losses

- Some Brittish based banks have been nationalised or the government at least has a majority share in them.

- Consumers are worried about their bank deposits

- Businesses are finding it very difficult to borrow money on reasonable terms.

- The government have set up a scheme to try to aid small businesses obtaining finance.

- Consumer spending is generally down and this has ;ed to some high profile businesses going bust such as Woolworths.

- Those businesses that are in a weak position before 2007 are unlikely to survive the Credit Crunch because they will find it difficult to obtain credit and demand will further fall.

- Customers are trading down,this will find it difficult to obtain credit and demand will further fall

- Price competition is becoming harder

- Product ranges and marketing strategies are changing

- There is a risk of a downward spiral of prices.

- Retailers are reducing costs by making redundancies,shutting branches and reducing expenditure where possible.

- Sales in 'big ticket' items are falling very fast.

- There are opportunities for some businesses,especially in discount goods and on-line retail.

- Businesses that supply the retail industry services such as marketing are suffering.

- MAnufacturing output is in fast decline

- This has impacted upon car manufacturers very badly

- In an attempt to reduce costs wages are being frozen and short term is being implemented

- Job uncertainty is having an interesting impact upon worker motivation

- Tension is increasing regarding industrial relations and the risk of industrial action is relatively high.

- Falling exchange rates should provide a stimulus for the manufacturing industry

- The stimulus is not happening,however ,because of the global nature of the crises and the increase in the cost of imported raw materials and components.

This shows what is happening to the UK house prices in terms of credit crunch.

The data used to create the graph above is publicly and freely available from the Nationwide Building Society. It's a graph that is very valuable to timing when I buy a property, and it will be to you once you have finished reading this.

Now that the UK government can no longer hide the fact that house prices are falling, lets see how we can use this to our advantage.

The Last Crash: 1989 - 1996

It took 7 years for the crash to bottom out (B) , wiping out 30% of the price of an average home in the uk. If anyone was convinced by the government to buy on the downslope (A) they risked massive falls in the value of their homes and also negative equity or even repossession! You should never buy on a downward slope as you simply don't know when you are going to hit the bottom.

This Crash: 2008 -

We have JUST started our decline this time around, the tipping point was 2008. Point (C) is the current point in our crash, the continuing black line is there for illustration as to what might happen next, based on the last crash. I am confident that we are going in to a dip, I just don't know how long or deep this crash is going to be this time around.

You can at least agree that if you buy now, you are staring in to a chasm with no idea how far you are going to fall.

When to buy:

The best time to buy is after the bottoms (B,D), but "what if you miss the bottom?" I hear you say. It does not matter! Even if you miss the bottom by 1 year, as long as you are buying on the UP slope you wont be a loser, all you have to do is monitor the data above and sit back and wait - my personal opinion is that you have at least 5 years - think of the deposit you could save!

Green shoots of recovery:

You should now understand why when the government talk about the green shoots of recovery it is a complete embarrassment. Why do the government want to trick you in to buying on to the down slope? They are not happy only with increasing your taxes to bail out the banks, they want you to also PERSONALLY sign up to massive amounts of mortgage debt to save the banks. Money , which could be better spent on your family.

We are only at point C - yet labour are actively telling people to buy before prices start going up again.

Well - now you know, the next time a politician on TV tells you to work as a mortgage slave for the rest of your life, you can tell them where to go - just keep tracking the above graph.

OH FINALLY,I FINISHED THIS TOPIC!!!!!

CONGRA TO LEX!!!!

Wednesday 1 April 2009

Easter Course!

Well,I learnt a lot and revise also carefully step by step all stuffs from the start.Old knowledges I know more clearly and new things added to my brain as well.=))

Teachers are working really effectively and I think students ,who are doing it, are really hard workers.

We do a lot in one day and very concentrated and enjoy it and... and also studying very hard that we even forgot the time....= =

Mr.Chris is teaching very enjoyable and trying hard even it's late and students who are staying later VOLUNTARY have lots of opportunities to learn more!...

Anyway,thanks for an Easter course!.....= =....=))